does maryland have a child tax credit

One of the changes with tax reform is that children are now required to have an SSN by the due date of their return to be qualifying children for the CTC and the ACTC. If the property is owned jointly by more than one individual such as a husband and wife each individual owner is.

Hoyer Maryland Families Can Breathe Easier Thanks To The Expanded Child Tax Credit Congressman Steny Hoyer

If you are a married couple filing separately or jointly or you have at least one.

. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. This rule is effective for. Every child deserves a chance to grow up free from hunger free from poverty and.

The credit would be available to all children up to age 5 while maintaining. If the property is owned jointly by more than one individual such as a husband and wife each individual owner is entitled to. Its a welcome boost to tens of millions of American families with young children.

The maximum federal EITC amount you can claim on your 2021 tax return is 6728. The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child between ages 6 and 17 per year. Does Maryland have any program to support an adoptee whose adoptive parents die until the child is adopted again.

What Is The Maryland Tax Credit. The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child between ages 6 and 17 per year. The credit would be available for families with income under 15000 up from the current 6000 limit.

With the child care tax credit you can claim up to 35 of 3000 in dependent care expenses the same rules apply as above per child or 6000 for two children. The credit can be claimed on Maryland forms 502 504 505 or 515. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children.

The enhanced child tax credit will help so many families and children in Maryland. More information on EITC can be found online at the Comptroller of Maryland the Internal Revenue Service IRS CASH Campaign of Maryland or by calling the following. The credit can be claimed on Maryland forms 502 504 505 or 515.

By Eduardo Peters August 15 2022 August 15 2022 For each additional 1000 of income above 30000 you add 90 to 1680 to find. If the portion of rent attributable to the assumed property taxes exceeds a fixed amount in relation to income the renter can under specified conditions receive a. The IRS has started distributing payments for the child tax credit.

Does Maryland offer a state adoption tax credit.

Nearly 80 000 Maryland Families Eligible For Child Tax Credit Money Have Not Received It Wbff

Maryland Senate Advances Bill Providing Tax Credits To Business That Offer Paid Sick Leave Baltimore Business Journal

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979633/GettyImages_1369365621.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Congressman David Trone Explains Child Tax Credit Youtube

Maryland R D Tax Credit Summary Pmba

Maryland Child Tax Credit Dc News Now Washington Dc

Tax Credit Available For Families With Children Dhs News

Child Tax Credit In Biden S Build Back Better Spending Bill Explained The Washington Post

Maryland Department Of Human Services

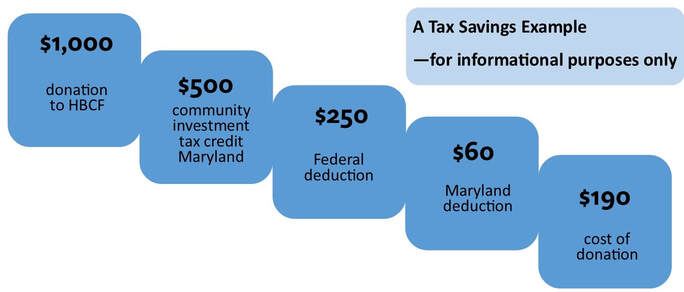

Maryland Community Investment Tax Credits Home Builders Care Foundation Of Maryland

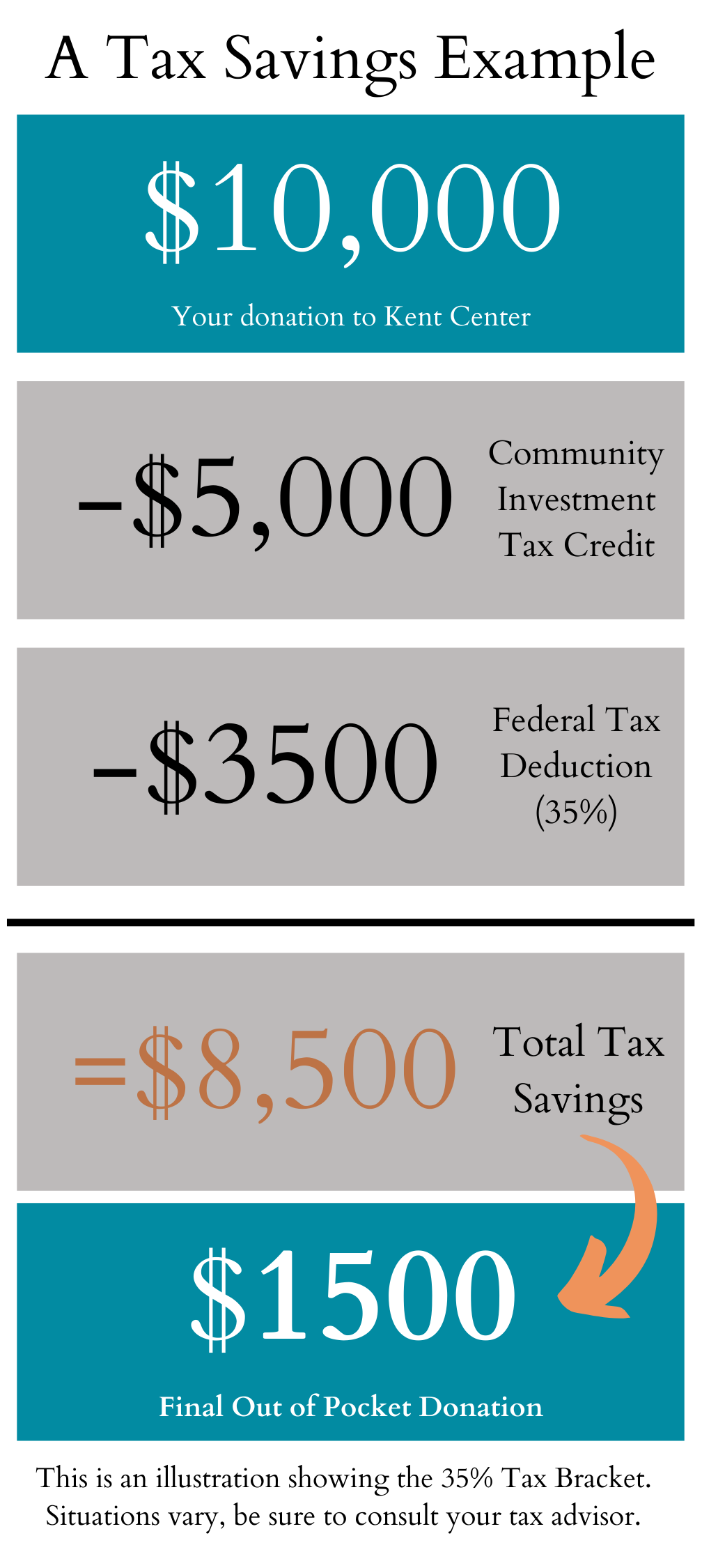

Community Investment Tax Credits Kent Center Maryland

Child Tax Credit Payment Recipients Should Keep Eye Out For Irs Letter 47abc

Newsletter Monthly Payments Are On The Way To Hardworking Maryland Families Congressman Steny Hoyer

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Millions Of Families Miss Out On Child Tax Credits Worth Up To 3 600 How To Claim Before It S Too Late The Us Sun

Charles County Maryland Tax Incentives Credits Charles County Economic Development

Biden S Expansion To The Child Tax Credit Pulling Kids From Poverty Democrats Just Have To Pass It